# The Development of Medical Malpractice and Its Legal Manipulation

Medical malpractice has consistently been a controversial topic within the healthcare sector. Even in highly secure medical environments, inadvertent unfavorable outcomes—often termed “errors of nature”—can arise. Nonetheless, over the years, a sector has developed that benefits from framing these natural incidents as instances of medical negligence. This legal manipulation, originating in the 1960s, has had a notable impact on malpractice insurance, patient compensation schemes, and the healthcare landscape as a whole.

## The Emergence of the Medical Malpractice Sector

During the 1960s, California experienced the emergence of lawyers who took advantage of unfortunate medical results, initiating lawsuits against healthcare providers to obtain settlements. Given that medical malpractice cases typically operate on a contingency basis—where attorneys are compensated only if they win—there was little risk involved in pursuing claims, even those lacking merit. This trend quickly propagated throughout the nation, leading to a surge in litigation.

By converting random medical outcomes into purported medical mistakes, these attorneys capitalized on patients’ distrust of malpractice. What started as isolated claims gradually evolved into an expanding business model, with aggressive marketing enticing potential plaintiffs into free legal consultations.

## The Effects on Malpractice Insurance and Healthcare Expenses

As lawsuits increased, medical malpractice insurance premiums rose accordingly. To mitigate costs and prevent a financial crisis, many states established **patient compensation funds**, funded by a surcharge on doctors’ liability insurance premiums. The concept was for malpractice carriers to handle initial claims, with larger claims covered by these funds. However, attorneys began to inflate damage claims beyond policy limits, leading to the bankruptcy of these funds.

In response, **joint underwriting associations (JUA)** were established as a solution, necessitating higher liability limits. Physicians paid surcharges for participation and were allocated $1 million per claim and $3 million total coverage. Nevertheless, attorneys continued to pursue higher damages, rendering JUAs financially precarious. Currently, only eight states maintain these programs.

As the 1970s and 1980s progressed, insurance models underwent significant transformation. **Occurrence-based** malpractice insurance, which covered claims as long as the patient was treated during the coverage period, was supplanted by **claims-made** policies. These newer policies mandated that doctors maintain continuous coverage, or risk being uninsured for any malpractice claims filed post-policy cancellation. The initial transition yielded temporary cost savings, but over five years, the “maturity” of claims-made policies led to increasing costs again. Physicians exiting medical practice were compelled to purchase costly tail coverage to safeguard against future claims.

## Continuous Reform Endeavors

The relentless rise in malpractice litigation prompted alternative solutions, such as:

– **Self-insurance** – Groups of doctors pooled their resources to insure themselves.

– **Physician-hospital alliances** – Hospitals and physicians collaborated to manage liability.

– **Reciprocal insurance and captives** – Physicians collectively financed their own insurance policies.

– **No-fault insurance and birth injury compensation schemes** – Certain states adopted no-fault frameworks to avoid the necessity of lawsuits in cases of birth injuries.

– **Tort reforms** – By the mid-2000s, various tort reform initiatives aimed to cap damages and restrict attorney fees.

Between 2003 and 2006, medical malpractice premiums nearly **doubled**, sparking widespread alarm. By 2017, **98 tort reform laws** were enacted across the United States as lawmakers sought to address the litigation crisis. However, as many legislators are attorneys themselves, their interests often align more closely with the legal community than with healthcare professionals. Some reforms imposed damage caps, while others restricted attorney contingency fees, but legal practitioners often discovered loopholes to circumvent these regulations.

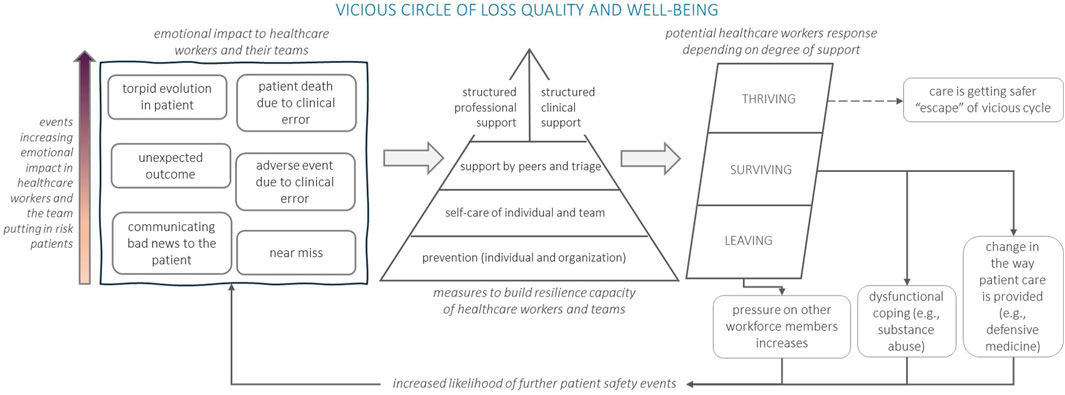

Despite these initiatives, malpractice claims continued unabated, and physicians increasingly engaged in **defensive medicine**—ordering additional tests and procedures not necessarily for the patient’s benefit but to shield themselves from potential legal repercussions. This conduct further escalated healthcare costs.

## The Facade of Stability

According to data from the **Medical Liability Monitor**, from 2010 to 2018, malpractice premiums increased no more than 10% each year, creating a misleading sense of stability. However, underlying systemic issues persisted.

By 2018, this illusion was dispelled as average premiums surged by 10%, and the severity of malpractice claims intensified. High-risk specialties, such as obstetrics and neurosurgery, experienced annual premiums ranging from $50,000 to **$215,000 per physician**.

Today, the outlook remains grim:

– At least **85,000 medical malpractice lawsuits** are lodged annually.

– **60,000 of these cases** are classified as frivolous.

– The number of practicing lawyers in the U.S. has reached unprecedented levels.

– Bureaucratic health policy experts contribute to soaring costs without addressing excessive litigation.

– In 2004, **34%