# **The Significance of Measurement in Management: An Examination of Medical Malpractice Insurance**

The core tenet of management science, “What gets measured gets managed,” is applicable across different fields. This is particularly evident in the medical malpractice insurance industry. This article examines a failed reciprocal insurance firm in Washington, D.C., illustrating how inadequate measurement and cost control led to its collapse. It also delves into wider ramifications for the sector and potential remedies.

## **The Decline of a Medical Malpractice Insurer**

In 2001, a little-known reciprocal insurance company in Washington, D.C., faced significant challenges. At its zenith, it insured two-thirds of the physicians in the city, yet by 2004, it was no longer operational. The company received an “AMB3” rating from AM Best in 2001, indicating merely an “adequate” capacity to fulfill its financial obligations. This rating served as a cautionary sign of forthcoming fiscal troubles.

An in-depth review of its claims data from 2001 reveals crucial insights. The insurer engaged in litigation for 20 cases but settled just two, resulting in a 10:1 litigation-to-settlement ratio. Over 25% of litigated cases culminated in plaintiff verdicts, leading to expenses of $6.7 million for the company. The firm’s hesitance to settle cases resulted in exorbitant legal fees, costs that could have been entirely avoided.

Despite these concerning statistics, an even more crucial figure would have been the “claims-to-premium ratio,” a key metric within the medical malpractice insurance domain. However, the company failed to disclose this ratio—a warning sign of mismanagement. Without a grasp of and control over this ratio, effectively managing claims costs is nearly unfeasible.

## **Grasping the Significance of the “Claims-to-Premium Ratio”**

The “claims-to-premium ratio” is an imperative success determinant in medical malpractice insurance. In 2015, the leading 15 medical liability insurers collectively reported premiums amounting to $5.3 billion, combined with an average claims-to-premium ratio of 1.6, indicating they faced $8.8 billion in claims.

The findings suggest a disturbing pattern: if larger insurers with significant resources struggle to maintain profitability, smaller firms with limited economies of scale are at an even higher risk of failure. This begs the question—if the industry-standard metric isn’t effectively preventing insolvency, is it genuinely valuable?

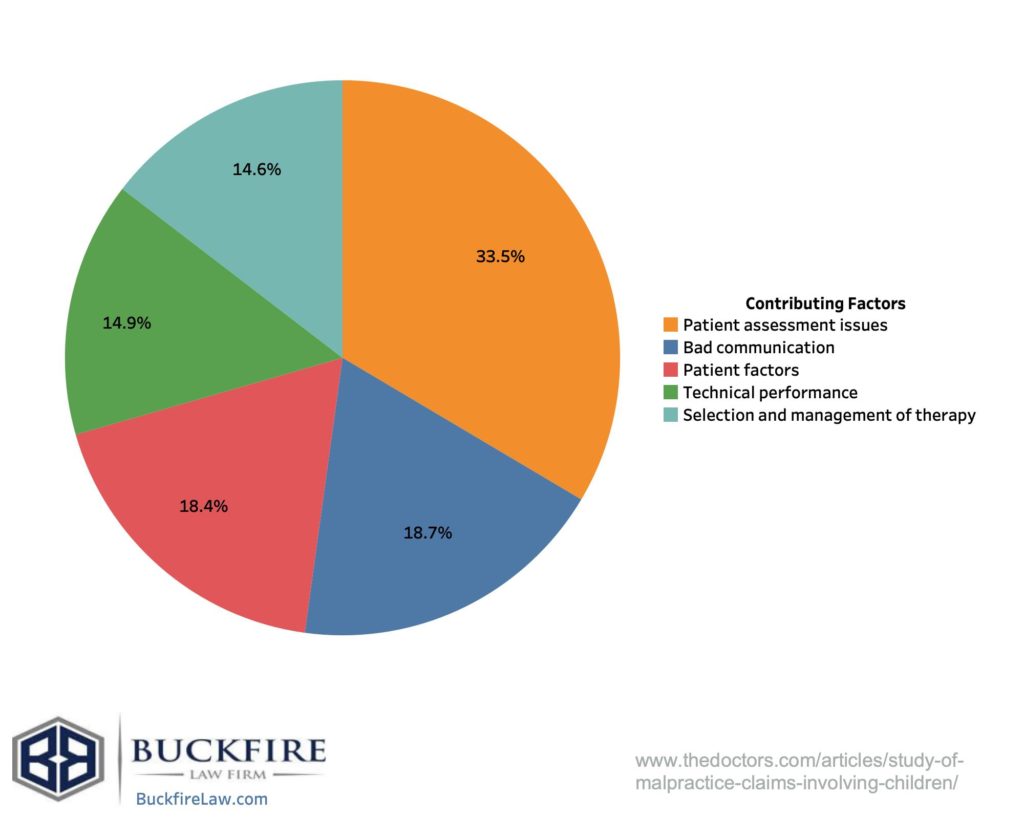

## **A Cost-Driver: The Primary Source of Losses**

To regulate the “claims-to-premium ratio,” identifying and overseeing the actual cost-driver—the factor leading to elevated claims expenses—is essential. The culprit is rooted in legal costs, particularly the dependability of expert witness testimonies in malpractice litigation.

A pioneering 1975 study by scholars at the University of California’s School of Health Policy and Management scrutinized medical malpractice litigation. They discovered that establishing causation was fraught with bias stemming from expert witness opinions and court evidentiary standards. The court system’s dependence on expert testimonies produced inconsistencies, rendering litigation an ineffective means of identifying medical fault.

To tackle this concern, the study proposed the **“coefficient of causality”**, a statistical measure that quantifies the probability that a medical incident resulted in an injury with 95% certainty. This statistical endorsement mitigates bias and delivers objective evidence in cases, effectively avoiding costly and unwarranted legal conflicts.

## **Utilizing the “Coefficient of Causality” to Control Costs**

Had malpractice insurers embraced “scientifically effective” methods, such as the **coefficient of causality**, they could significantly have curtailed claim expenses. Instead of depending on subjective legal reasoning and expensive litigation, insurers could have utilized data-driven strategies to ascertain if medical negligence genuinely caused patient harm.

By assessing **“dollars per erroneous expert opinion,”** insurers would have directly overseen claim costs. This strategy would not only reduce superfluous legal expenses but also foster a fairer, evidence-oriented system where medical professionals are held accountable only when valid scientific proof of malpractice exists.

## **A Missed Chance: The Cost of Disregarding Science**

For nearly half a century, the medical malpractice insurance sector has neglected to implement scientifically validated techniques. The outcome? An astonishing **$2.5 trillion in avoidable costs**, translating to over **$1,550 per individual per year** in the U.S. If this systemic inefficiency persists, it could threaten the future of healthcare as we understand it.

## **Conclusion: An Opportunity for Reform in Medical Malpractice Insurance**

The collapse of this minor reciprocal insurance firm in Washington, D.C., highlights a larger concern within the medical malpractice industry—the inability to efficiently manage claims costs due to flawed litigation practices. The **coefficient of causality** presents a data-backed alternative to expensive legal confrontations, potentially revolutionizing the handling of malpractice claims.

For physicians, this conversation is far from theoretical—it is personal. Every practicing physician will inevitably confront a malpractice claim. Establishing a system that reasonably differentiates legitimate malpractice from baseless claims based on scientific confidence could transform