**Navigating Two Realms: A Doctor’s Perspective on Health Care and Global Economics**

As a child of immigrants and a medical professional, I gained a distinctive outlook on both health care and global economics long before engaging in formal studies of these systems. Observing the sacrifices and difficult choices required to manage these responsibilities across different regions was enlightening.

The lasting memory of my mother’s unwavering commitment is clear. Her limitless energy shone through as she juggled laboratory tasks, hospital responsibilities, and after-hours calls while also coordinating family logistics over vast distances. Trips back to Calcutta, India, known for its doctor exports, involved bringing suitcases filled with items like lipstick and Keebler’s Sandies crackers, connecting distances with symbols of affection.

More crucial than these were the remittances—financial assistance sent back home for day-to-day expenses and urgent health needs. I recall the urgency and careful consideration surrounding the transfer of funds, which was vital for health care in the absence of safety nets.

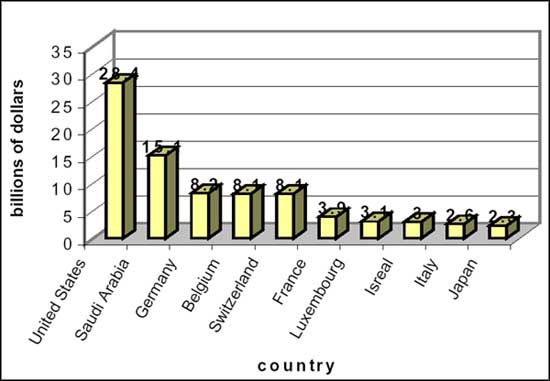

Remittances, although apparently modest, signify considerable financial streams. Per the 2024 World Bank data, India leads the recipient list with $129 billion. These support mechanisms function as informal insurance, addressing health care requirements in countries with fragmented systems, thereby easing the pressure on public health resources.

In addition to health, remittances also stimulate entrepreneurial endeavors, promoting stability in precarious environments. Nevertheless, proposals for a 3.5% remittance tax threaten this vital support, increasing the costs associated with sending money, which is crucial yet burdened with high transfer fees worldwide.

Imposing taxes on remittances risks driving senders toward untraceable, informal channels, which pose safety concerns. This undermines the principle of nurturing global talent and may lead professionals to reconsider the feasibility of remaining in the U.S. Such policies could accelerate a reverse brain drain.

In a globalized environment, remittances are indispensable, acting as economic investments and emotional connections that bolster healthcare and development. Preserving these ties without imposing additional burdens honors the fundamental values of inclusion and opportunity.